The Rise of the Robo Advisors

Ever heard of Robo advisors?

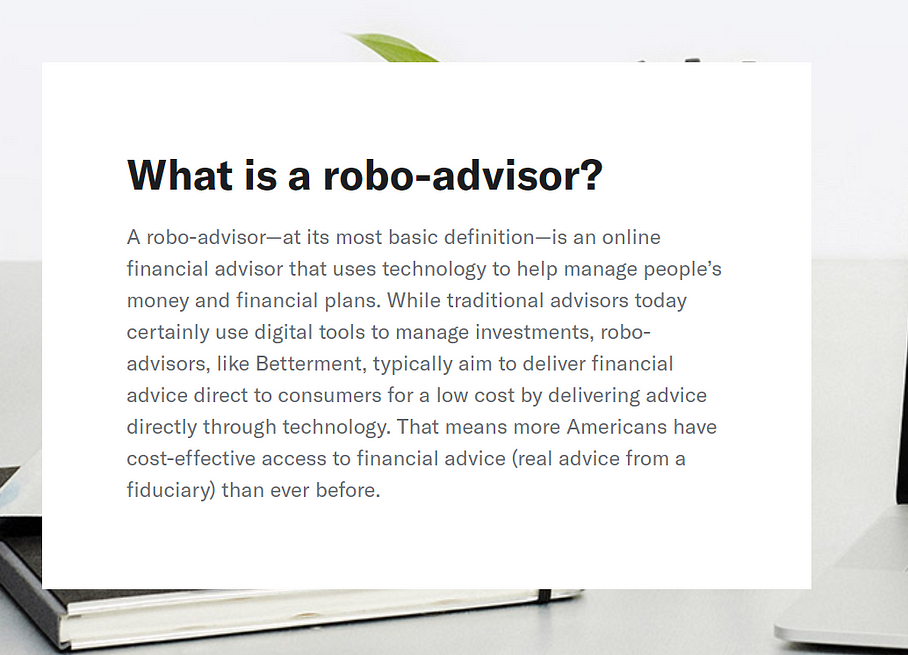

A robo advisor is an online platform or application that uses algorithms and artificial intelligence (AI) to provide investment advice and manage investment portfolios. Robo advisors are typically designed for retail investors who are looking for a low-cost and convenient way to invest their money, and they are often used as an alternative to traditional financial advisors and investment managers.

I had the opportunity to work as a software engineer intern for a startup working on a Robo advisor. Robo advisor has been there for quite some time in the USA market, but the Indian market hasn’t seen such adaption.

Yes, there are few companies that are claiming to offer a financial planner, but they’re far from a fully-fledged Robo advisor such as Betterment.

In this article, I’m gonna share my own views on what a Robo-advisor is, and is India market-ready for adaption at scale?

Before we start, a little about the company I’ve been working with.

Finception is a Bengaluru based FinTech startup. Co-founded in 2018 by three IIM Ahmedabad graduates Bhanu, Shrehith, Pawan, and one IIT Delhi graduate, Lokesh Gurram. Finception aims to make stock markets more accessible to the layperson. The platform uses storytelling as a key feature to simplify the content featured on their platform.

Understanding the market

-

In the past decade, India has seen significant growth in capital investments, government policies, and an entrepreneurial mindset. This leads to the emergence of the 2018 saw $128 billion invested globally in fintech. Investment in the sector is expected to grow to $310 billion by 2022, a 25% annual growth rate. (Source: Deloitte)fintech industry.

-

2018 saw $128 billion invested globally in fintech. Investment in the sector is expected to grow to $310 billion by 2022, a 25% annual growth rate. (Source: Deloitte)

-

EY’s Global FinTech Adoption Index 2019 says that India, along with China, leads emerging markets with a high 87% fintech adoption rate in 2019.

Robo Advisor — The next big thing in FinTech domain

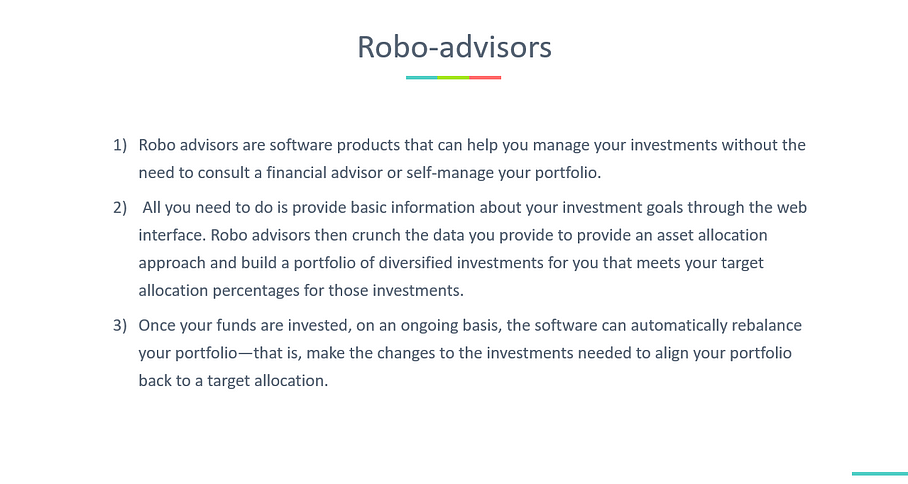

- Robo advisors are software products that can help you manage your investments without the need to consult a financial advisor or self-manage your portfolio.

- All you need to do is provide basic information about your investment goals through the web interface. Robo advisors then crunch the data you provide to provide an asset allocation approach and build a portfolio of diversified investments for you that meets your target allocation percentages for those investments.

- Once your funds are invested, on an ongoing basis, the software can automatically rebalance your portfolio — that is, make the changes to the investments needed to align your portfolio back to a target allocation.

Who needs Robo-advisor

Beginner or young investors: These investors may not yet have the financial knowledge needed to make informed investing decisions

Professionals: These individuals may not have time to actively manage their funds and may want to put their portfolio on “automatic.”

Investors who don’t want to hire a financial advisor

Understanding the problem

Traditional Approach

Investors today can build and manage their portfolio in one of three main ways:

- Hire a financial advisor to create an expertly curated portfolio.

- Use a do-it-yourself approach to pick investments.

- Enlist a Robo-advisor to put together a portfolio. Access to Robo-Advisor services through a Financial Advisor

Is Robo-advisor new?

The takeover of the robots in the classic field of wealth management is an emerging trend across the global industry.

Robo-advisor is common in the USA, but in India, the market is still wide open and there is no existing product offering fully-fledged capabilities.

One such example is Betterment. Betterment is credited as the oldest Robo-advisor and has grown to the top of the heap. Betterment has $13.5 billion in assets under management, making it the largest of the independent Robo-advisor firms. (https://www.betterment.com/)

How are we solving the problem?

Finception aims to develop a personalized Robo-advisor to help millennials manage their finance efficiently and transparently.

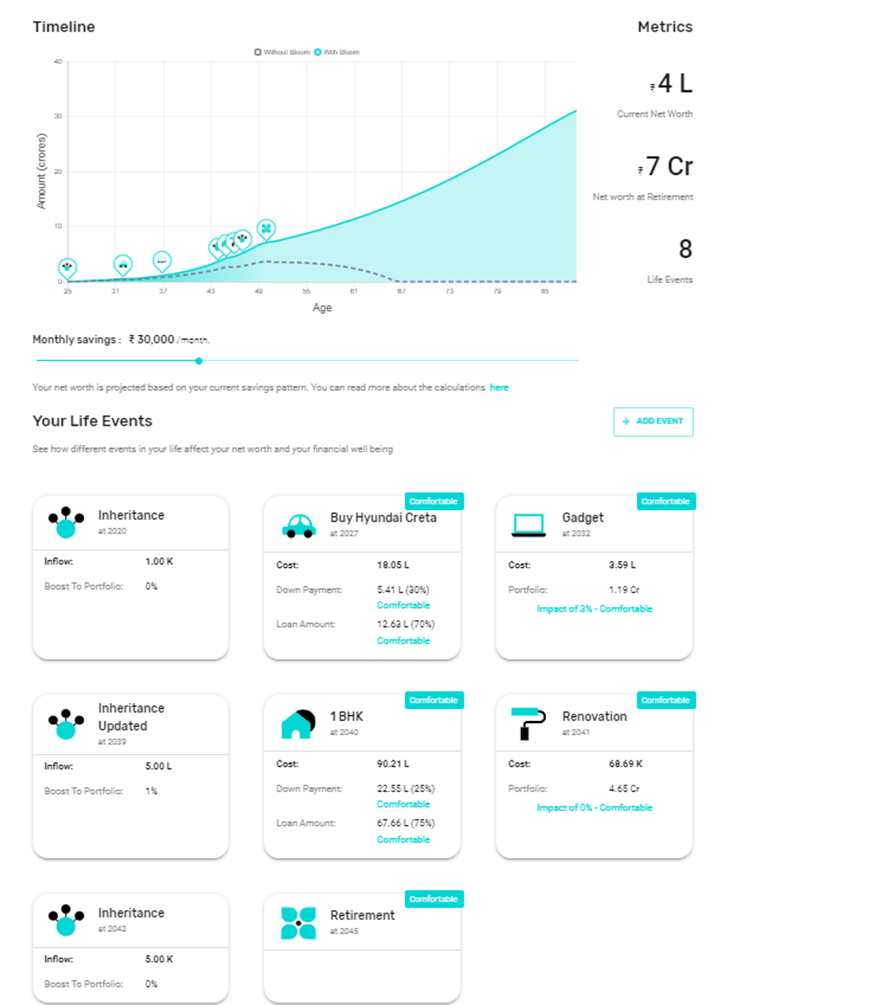

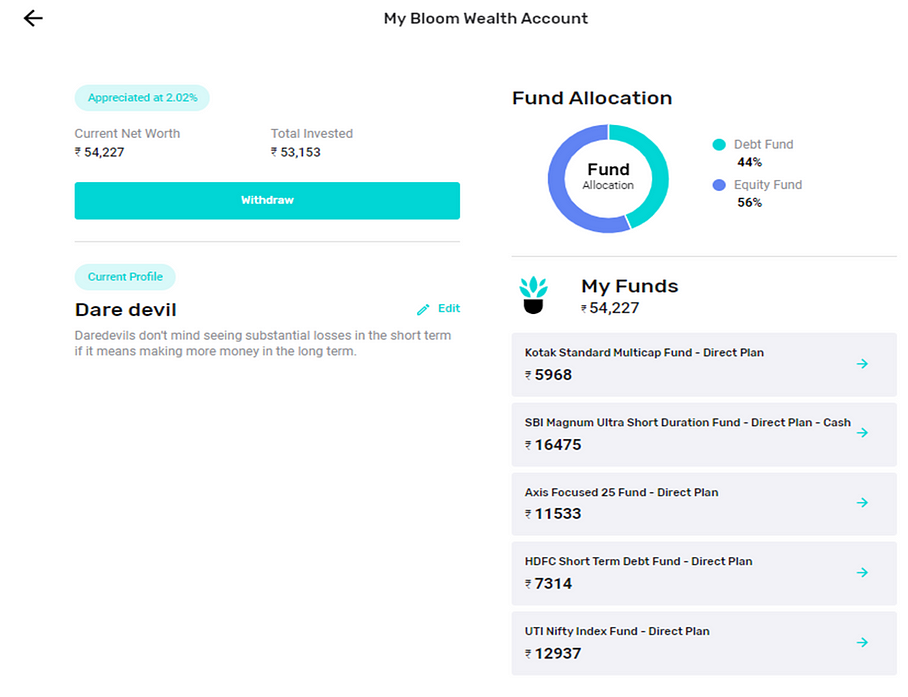

With Plumo, millennials like me with little or no understanding of stock market can avoid investing mistakes, can automate the process and can invest a smaller amount at a lower cost.

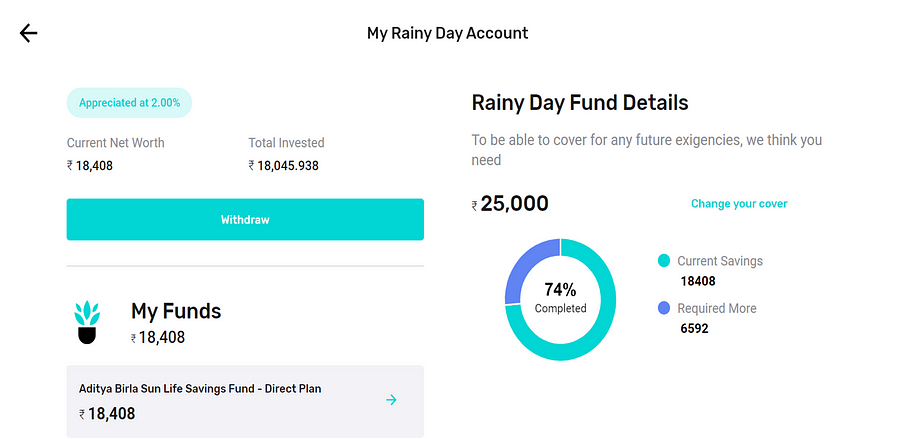

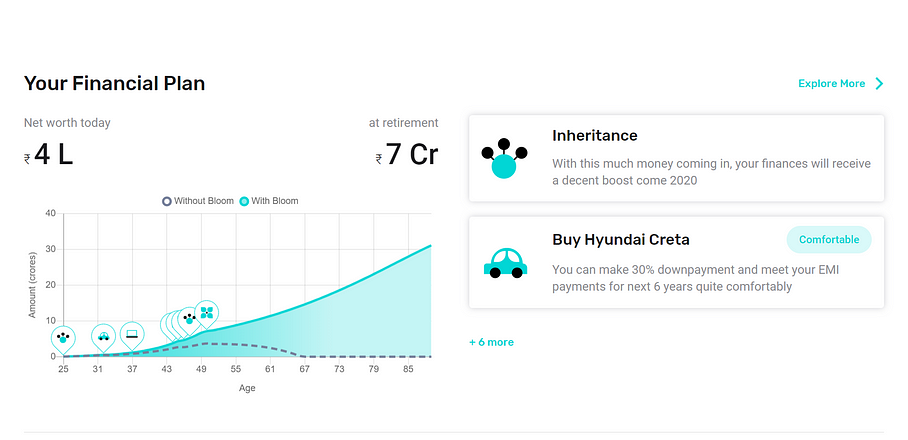

A look inside Plumo

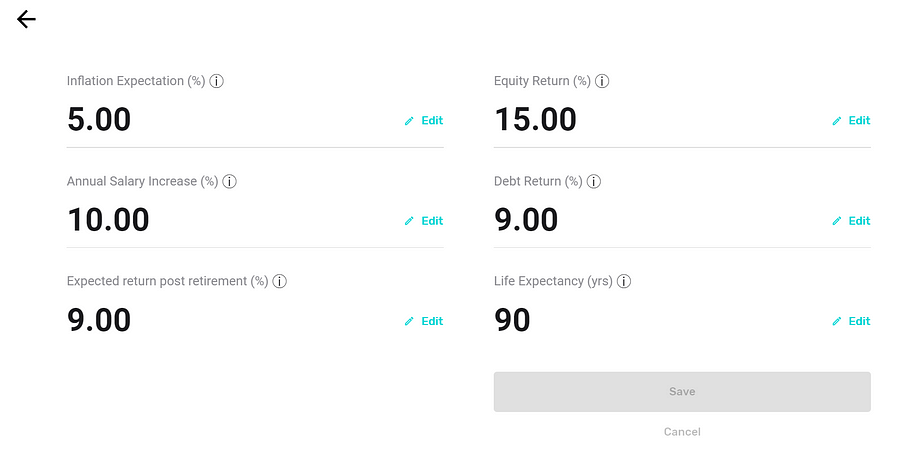

We aim to develop a Financial Planner app which will be available on web and mobile (android and iOS)

My contribution

My takeaway

Working in a young start-up is always a challenge.

The team size is generally small, which means more responsibility and more learning opportunities.

The feeling of writing code that will be used in production and could potentially be used by millions of people is overwhelming.

The work culture of a startup. The workflow is extremely productive and you’re expected to develop fast, fail, learn from mistakes, and iterate.

Working in a fast-paced environment, with experienced senior developers helped me learn and lot and helped me become a better developer.

Chance to work in new technologies that helped me pick up in-demand skills. It also helped me think from a scalability and maintainability perspective.

Tech is just a tool, try to look at things from a business perspective, figure out what the customers want. Other things are equally crucial. Try not to be too tech-centric.

My takeaway

I learned a lot during my 5 months working as a software engineer intern at Finception. I had a lot of fun understanding the finance market and building the Robo advisor.

Plumo has the potential to change how millennials plan their finance and how robo advisor can help them achieve their goals efficiently.